In 2022, the largest European PV market was Spain with 8.4 GW of annual installed capacity.

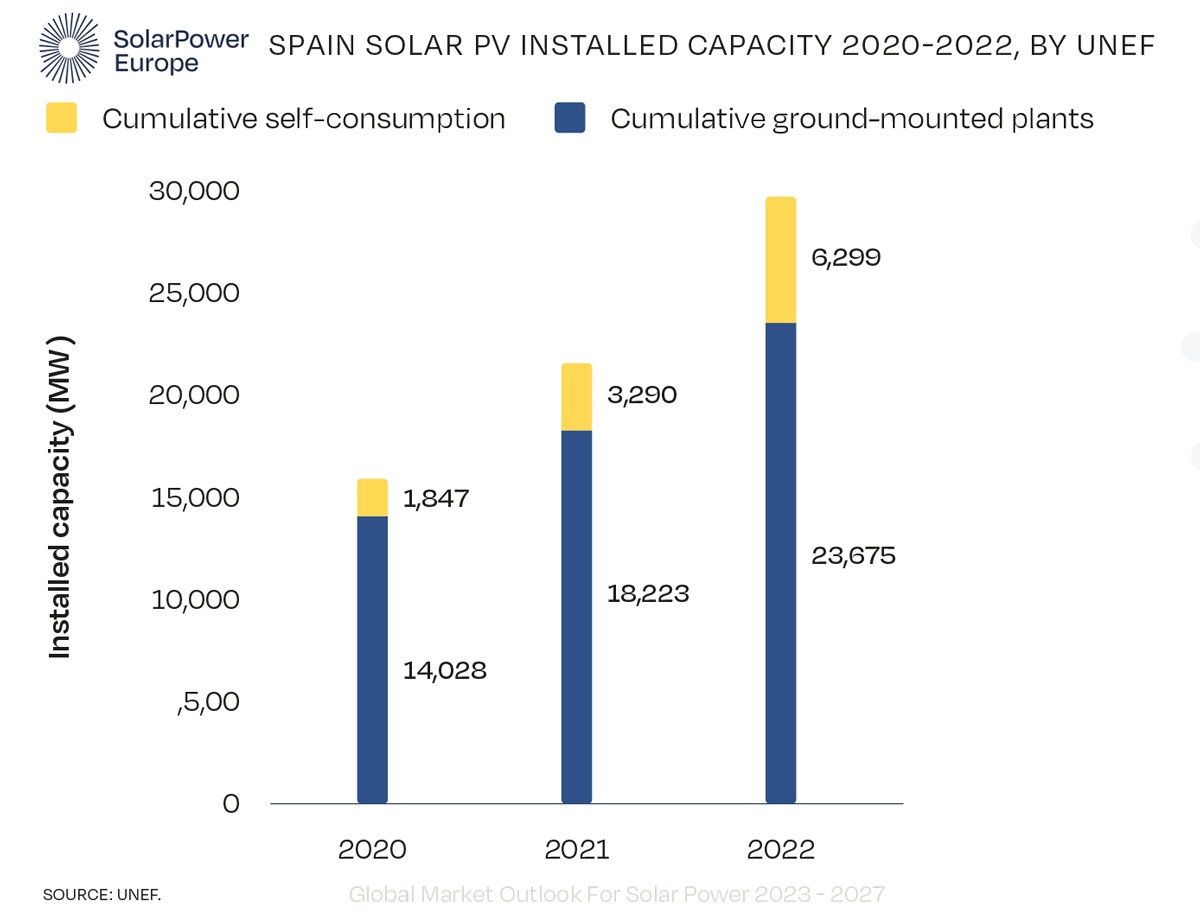

By 2020, a total of more than 18 GW was installed with a 156% increase in the PV installation.

Targets for renewables by 2023

After a process lasting several years, the Spanish Parliament passed the Climate Change Act in May 2021, setting targets for renewable energy in 2030.

A double target was set for 2030 with a 42% share in final energy consumption and a 74% share in renewable electricity production.

In particular, Spain’s National Plan for Climate and Energy (PNEC) currently plans to reach a solar photovoltaic capacity of up to 39.2 GW in 2030.

Spain places great emphasis on renewable energy and, in order to maintain a high level of public and private investment, has decided to take advantage of all transfers and loans allocated to the country by the European Union.

National Recovery and Resilience Plan (NRP) of Spain

Madrid has thus announced its entry into ‘Phase 2’ of the Plan de Recuperación, Transformación y Resiliencia (Prtr), Spain’s National Recovery and Resilience Plan (Pnrr).

The first package was then complemented by additional EU funds including resources from the RepowerEU chapter (€2.6bn).

In this RepowerEU section, a number of administrative measures were included to promote renewable energy installations in order to mitigate the impact of energy prices on vulnerable consumers.

The package of measures includes, among other things, a regulatory framework for floating photovoltaics, fast-track procedures for solar parks, the expansion of grid capacity for self-consumption systems, and regulations for renewable gas pipelines, including renewable hydrogen.

In 2023, this plan will be revised upwards and new targets for solar PV capacity may increase, in a range from 50 to 65 GW.

Challenges and opportunities for Spain

The market for rooftop photovoltaics is developing at an accelerated pace. After the elimination of the ‘solar tax’ on self-consumption in 2018, the current framework was reached as of 2020 when automatic remuneration of surplus energy produced by the systems was introduced.

The main driving force behind rooftop photovoltaics are the high wholesale electricity prices, which act as a wake-up call for industrial and commercial operators as well as households.

All these segments look to solar as a means to reduce energy bills through the use of self-produced and consumed electricity at affordable and environmentally friendly prices.

Large ground installations

In the onshore segment, installed capacity in 2022 reached 5.4 GW, and to reach the 2030 targets it will be necessary for projects to obtain environmental permits within a short and reasonable timeframe.

Royal Decree-Law 23/2020, in fact, imposes strict deadlines on plants under construction: all projects with grid access permits must obtain authorisation within predefined timeframes.

Rooftop systems

For rooftop photovoltaics, the market in 2022 grew more than 108% year-on-year and exceeded 3 GW.

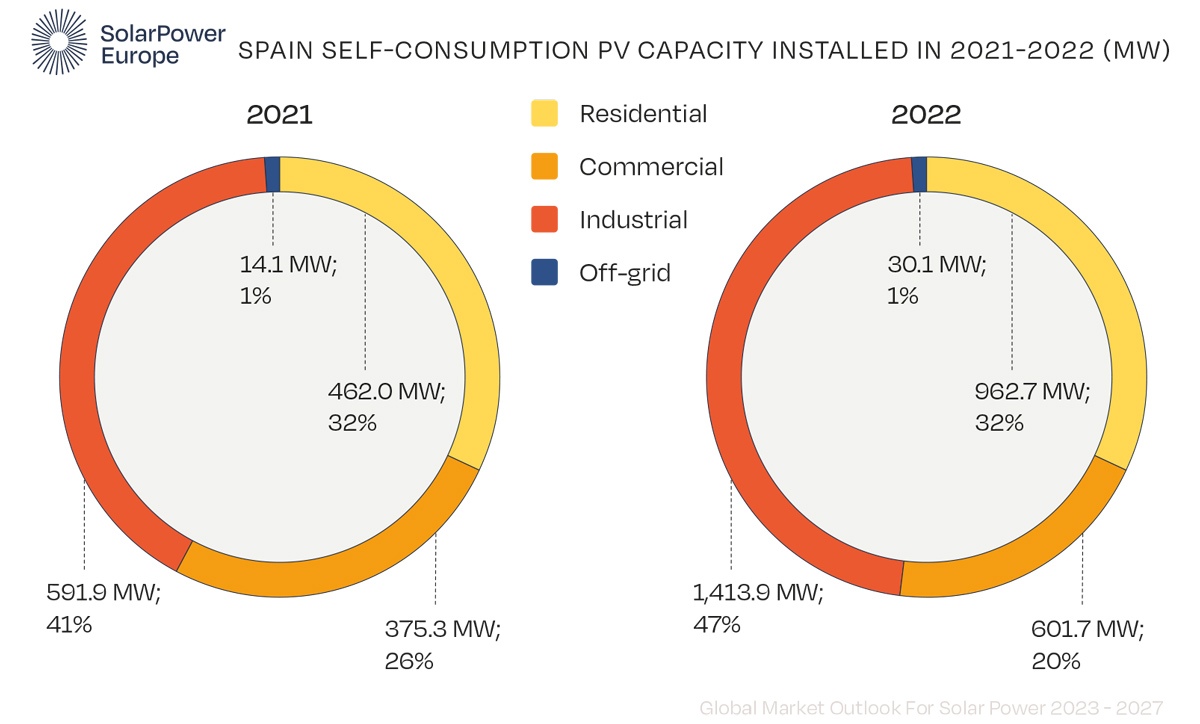

The exponential growth of installations in this segment mainly concerns industrial installations, which account for 47% of the total installed amount.

The Spanish government in the PNRR prioritises rooftop installations to speed up the energy transition by doubling the funds for these installations.

The main challenge now is again the long authorisation times (both administrative and grid), due to divergent processes between municipalities, and the reduced authorisation exemptions for grid access for rooftop PV.

Furthermore, delays in the implementation of the support programmes of the National Recovery Plans are slowing down the decision-making processes of consumers and developers, who are now waiting for funds to be available in their region.