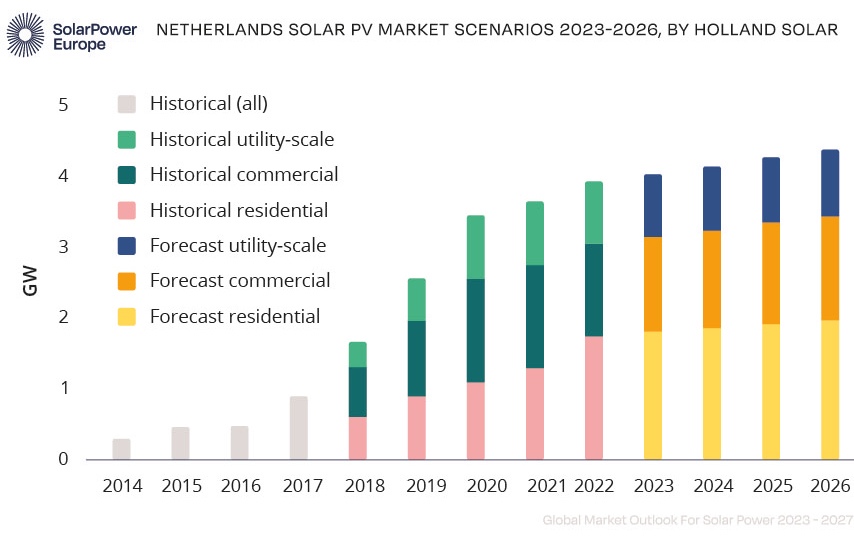

According to the Global Market Outlook for Solar Power report, the market in the Netherlands is developing strongly, with an addition of 3.9 GW of solar PV capacity in 2022 and a project programme already approved for 11 GW.

To date, the total Dutch photovoltaic park stands at 18.2 GW, including a surprisingly high growth of the residential sector, adding 1.8 GW in 2022.

The Netherlands also has a project reserve of 11 GW from its Sustainable Energy Transition Subsidy Scheme (SDE++) award-winning projects, with equal shares of commercial rooftop and ground-mounted projects. The Dutch solar energy market is expected to continue growing in 2023 and exceed 4 GW.

Residential, commercial and ground installation market

In 2022, the largest market segment in the Netherlands was the residential rooftop market, with a 46% share (about 1.8 GW) of the total market.

The commercial rooftop market accounted for a 30% share (about 1.3 GW), while the ground–mounted and floating solar PV market accounted for 24% (about 0.9 GW).

Local participation plays a more important role in regional energy strategies as set out in the National Climate Agreement, the renewable energy sector aims for 50% local participation in renewable energy projects.

Grants for co-operative projects

A new subsidy system, SCE (Cooperative Subsidy for Energy Production 2021) supports around 1 million organised citizens in the development of cooperative projects – representing a small, fast-growing market share of 1.5% of the total installed capacity.

Growth of commercial and industrial solar tendering system

The photovoltaic market in the Netherlands is driven by the SDE++ tender scheme, under which all project technology types compete against each other.

In this tender scheme, different maximum capacities are allocated according to category (photovoltaic, wind, biomass), size and application (ground, rooftop, floating) and then ranked by Euro per ktCO2 avoided.

In June 2022, a total of 2.3 GW of solar projects applied for subsidies, of which about 1 GW are land-based projects, 38 MW floating projects, and the other 1.3 GW are large commercial rooftop projects.

In 2023, the budget was increased by 17 per cent compared to the previous year, also due to rising costs.

Main challenges for the photovoltaic industry in the Netherlands

The main challenges for the solar energy sector in the Netherlands are the current cost levels of project development and ensuring a timely connection to the grid.

For these reasons, the sector expects to face serious delays and possibly more non-implementation of projects in the years to come.

Previous legal restrictions on cable pooling, which combines solar and wind projects in co-location with batteries, were partly resolved in 2023.

New projects applying for SDE subsidies (from 2022 onwards) must comply with a grid connection of a maximum of 50 per cent of the system’s peak capacity to be eligible to apply for a grid connection and subsidy scheme. The annual loss is compensated by the subsidy level per kWh.

For the first time, grid operators in the Netherlands have recognised the significant growth of the solar sector and estimate that between 42 and 76 GW of solar capacity will be installed by 2030.

Another challenge facing the sector is the availability of land, especially for large-scale projects, as well as a clearer policy regarding the use of agricultural land for solar energy projects.

Grants and support for the country’s future energy development and efficiency

The Dutch government is demonstrating through its policies and subsidies an ambitious plan to support renewable energy and photovoltaics.

It also introduces additional support for building standards and obligations.

Finally, the most important step in the near future will be to create effective policies on the electrification of industry, mobility and heating, which should go hand in hand with the creation of a level playing field for the flexible production of green electricity.