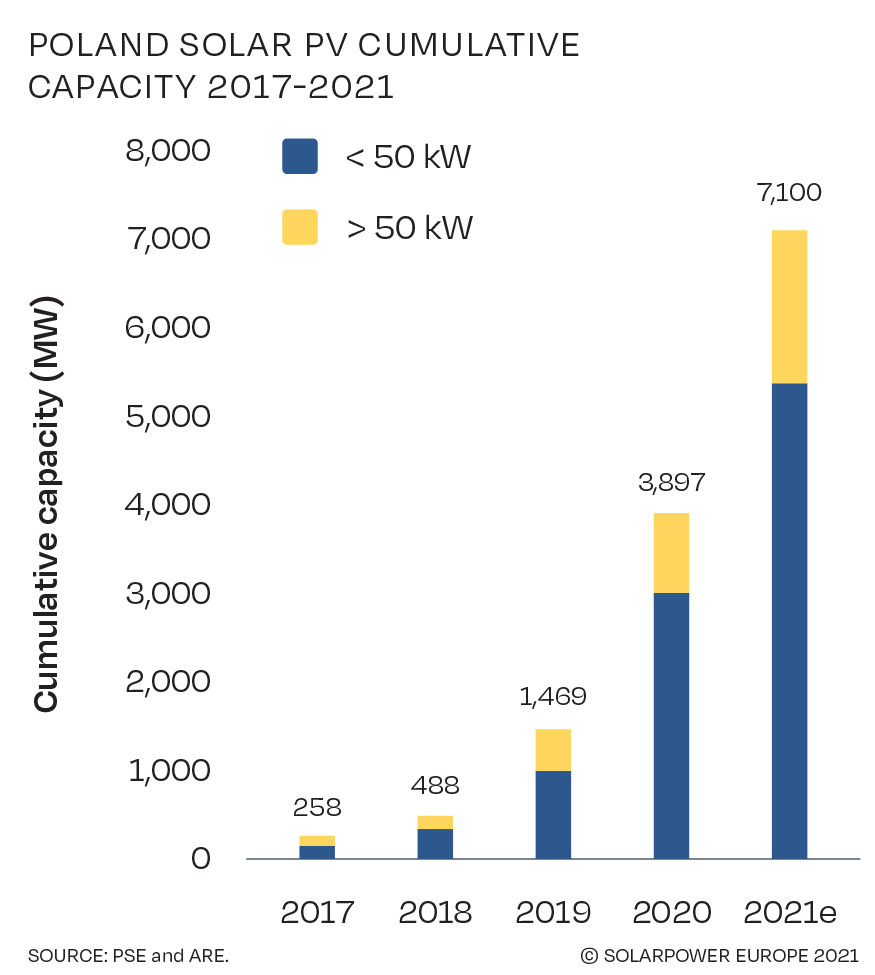

The photovoltaic market in Poland is very dynamic and has always exceeded expectations in recent years.

Solar Power Europe in its EU Market Outlook For Solar Power 2021 – 2025 predicts that the cumulative power will reach 7 GW at the end of 2021, so in the last quarter of last year the forecast is that 700 MW will be connected, compared to the latest historical data punctual which stops at 6.3 GW in September ’21.

Total installed power of 16.8 GW expected by 2025

In 2020 the annual installations were 2.5 GW with the prospect of growth of + 28%, so as to have new plants for 3.2 GW in 2021 and arrive at the aforementioned data.

In the medium term, Solar Power Europe always expects an annual growth of over 20% to reach a total installed power of 16.8 GW by 2025.

Incentive scheme for small plants below 50 kW

The incentive scheme that has expired on March 31, 2022 for small-sized plants below 50 kW was very convenient for Polish prosumers, as it provided for the energy injected with a coefficient of 0.8 in consumption for systems under 10 kW, while for plants between 10 and 50 kW a coefficient of 0.7.

For these systems there is no payment of commissions on connection and use of the network.

Other incentives for plants between 2 and 10 kW

In addition, approximately € 1,000 (PLN 5,000) of additional incentives are available for residential PV installation between 2 and 10 kW through the “My Electricity” program, with the possibility of income tax deductions.

Since this program has changed from 1 April 2022, Solar Power Europe in it’s Outlook, published at the end of 2021, foresaw an installation rush to entered into this scheme which gave very convenient payback times.

With the new subsidy that came into effect this spring, the energy injected will be paid at the wholesale price and the purchase will instead be at the normal price of the residential market

For large plants, the incentive scheme is that of tenders.

For large plants, the incentive scheme, as in many other European countries, is that of tenders.

The Energy Regulatory Office (URE) judges plants below 1 MW, which must be PV, differently, from plants above 1 MW which can also be wind. Tenders are held at least once a year and over time the large PV systems have outclassed the wind farms.

Just take in mind that in June 2021 the tender was for 1.5 GW and only 300 MW have been awarded to wind farms, while in the first auctions most of it was assigned to wind power.

The breakdown point took place after 2019 where the assigned power was equally distributed between these two technologies.

Ease of installation of photovoltaic systems

According to Solar Power Europe, another fact that will lead Poland to remain one of the protagonists in Europe in PV field is due to the relative fast installation of this technology, which is gradually replacing some old conventional power plants that are gradually being shut down due to their obsolescence.

A possible growth limit for Poland is the inadequate of the national grid distribution network

As in other countries, one of the problems that the EU Market Outlook For Solar Power 2021 – 2025 raises for the development of PV is the inadequate of the national grid that can’t support the connection of all this renewable power.

One of the ways to solve this problem in a fast way is to have common connection points for wind and solar plants, that is “cable-pooling”.

The basic concept is simple and is due to the typical nature of these two sources, photovoltaic modules make a greater contribution on spring and summer days, while wind power will make its contribution at night and in bad seasons.